CONSUMER RIGHTS LAW FIRM SERVING CLIENTS IN CHICAGO, ILLINOIS, AND NATIONWIDE

When you have mounting debt such as credit card bills, mortgage payments or healthcare expenses, the consumer rights lawyers at Markoff Leinberger in Chicago want you to know that you have rights. You may be able to avoid a constant barrage of phone calls from debt collection agencies.

You could have debt that you aren’t even aware of.

If you are suffering through debt collection activities that you feel are unfair or illegal, please contact one of the consumer rights lawyers at Markoff Leinberger today at 312-726-4162 to schedule your free case consultation.

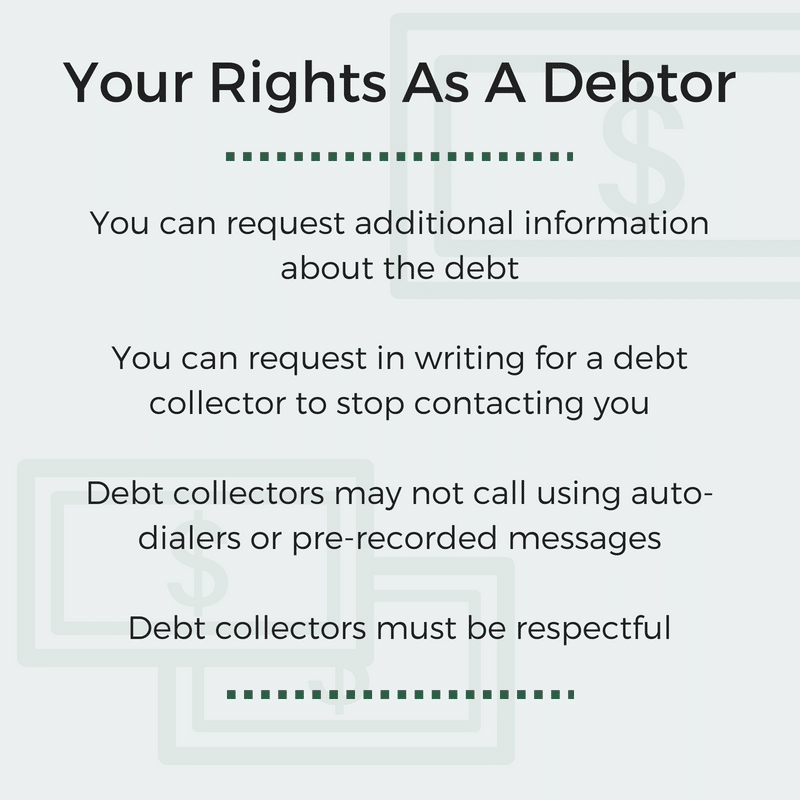

Your Rights As A Debtor

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive tactics from third-party debt collectors. Here is a shortlist of your rights under this act:

- Legal Contact Hours. Debt collection companies are only allowed to contact you via phone between the hours of 8 AM and 9 PM.

- Constant Phone Calls. If your phone is ringing nonstop to the point of annoyance or abuse, the company is violating the FDCPA.

- Contacting You at Work. Debt collectors are not allowed to call your place of employment at any time.

- Request a Stop in Communication. If you provide a written document requesting that the company stop contacting you, they must cease communication, except in very limited circumstances.

- You have the right to validate your debt. If you’re not sure why or what you owe, the company must provide proof of your debt. After you request this information, they may not contact you until you have received the document.

- Contact Without Your Attorney. Once you have notified the company that you have a lawyer, they can no longer contact you without your attorney present.

- You have the right to be treated with respect from debt collectors. They may not use profane language or communicate with your family members, neighbors, or coworkers. They can’t threaten you with false claims of arrest, imprisonment, or proseuction of a crime.

- It’s important for you to request proof of your debt to protect yourself from unjustified debts. When you answer the phone, they have to identify themselves and can’t falsely claim to be a police officer or lawyer. Debt collectors are not allowed to publish, or threaten to publish, false information to your credit report

Identify Illegal Actions

There is a long list of illegal actions under the Fair Debt Collection Practices Act (FDCPA). There are also several required actions included within the law. They include:

- Identity Disclosure. A debt collector must identify who they are at the beginning of each phone call. They have to notify you that all information you give will be used to collect the debt.

- Original Creditor. You have the right to the name and address of the company where the debt originated.

- Rights Explanation. Debt collection agencies are required to explain that you have the right to dispute your debt, and provide proof. They must mail you this information within five days.

Contact Our Legal Team Today

If you feel that your rights have been violated, contact Markoff Leinberger online or call 312-726-4162 today to schedule your free debt collection rights consultation. We serve clients in Chicago, Illinois, the Midwest, and nationwide.